SAP saw increased Cloud revenue during 2022

Key takeaways from the financial results

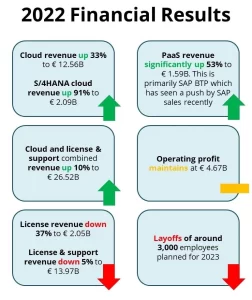

- Cloud revenue now accounts for almost 33% of all SAP revenue.

- S/4HANA Cloud revenue has almost doubled.

- RISE with SAP may be a contributing factor to the increase. We believe that the increase is due not to more customers but to the nature of RISE with SAP contracts.

We assume S/4HANA Cloud revenue will also include the RISE with SAP deals which SAP say are driving the adoption of S/4HANA Cloud. The introduction of RISE with SAP in 2021 left many customers confused about the way forward with SAP and what the RISE program entails. We have observed a strong sales focus from SAP on this program throughout 2021 and 2022. With such a large increase in revenue, it is probable that the focus on RISE with SAP will continue in 2023.

However, it could be that 2022 was not actually as strong for RISE with SAP as the headline results may indicate. Last year SAP noted in their financial results the positive increase in S/4HANA customers yet this year that statistic is surprisingly absent. You might expect it would be included if it was a strong result.

We can also consider that Year 1 of cloud contracts are often much lower in cost than following years due to the lower units required during the implementation phase, sometimes known as a “ramp up” contract. A brief example is shown by the table below. The 91% increase in S/4HANA cloud revenue might not be indicative of an increase in customers using RISE with SAP and instead be because the later years of a contract tend to be more expensive than earlier years.

| Licenses | Price | |

| Year 1 | 10 | $10,000 |

| Year 2 | 20 | $20,000 |

| Year 3 | 30 | $30,000 |

| Year 4 | 30 | $30,000 |

| Year 5 | 30 | $30,000 |

What to expect in 2023

Customers should expect that their conversations with SAP regarding S/4HANA will inevitably move towards the RISE with SAP program. However, it is important to note that other ways to move to S/4HANA are still available, such as the On-Premise Contract and Product Conversions, as well as moving to S/4HANA Cloud independently of RISE with SAP.

SAP saw decreased on-premise revenue in 2022

Key takeaways from the financial results

- On-Premise license revenue drops significantly, continuing the downward trend from the last few years.

- License Support revenue increases very slightly.

- The results indicate that customers are remaining On-Premise and are not investing further in their SAP software.

That license revenue dropped was not seen as a major concern by SAP and reflects that more customers are choosing cloud rather than on-premise solutions. When moving from On-Premise licensing models to cloud licensing models you will see a decrease in CAPEX costs but an increase in OPEX.

License revenue reflects new purchases of software, so a decrease in this figure indicates customers are not investing in their on-premise solution. However, if customers were actually cancelling their on-premise contracts in significant numbers and moving to cloud we would see a decrease in support revenue too. In fact, SAP reports a small increase of 3% in their on-premise support fee revenue. Although customers aren’t buying additional on-premise licenses, they aren’t cancelling their on-premise contracts either. Neither is this growth likely to reflect net-new customers choosing On-Premise in significant numbers as SAP strongly push their cloud solutions to net-new customers.

Following on from this is SAP’s September 2022 announcement that there would be a CPI increase of up to 3.3% applied to support fees from 1st January 2023. Though this will have an impact going forward it won’t have been a contributing factor in the 2022 financial results. Please see our explanation of the impact here. It’s important to note that this is becoming common in cloud contracts too. It could also be seen that SAP are raising the support fees to obtain more revenue from these customers who are choosing to remain on-premise.

What to expect in 2023

There is the 3.3% increase to support fees to contend with in 2023 and beyond so you will likely need a greater budget going forward. On-Premise is not a focus for SAP so it will be difficult for customers to negotiate a good deal or reduce their support fees by cancelling licenses without a corresponding purchase of cloud software. There could be disincentives for remaining on-premise, such as price increases.

Other key takeaways from the results

Profits remain static despite a strong revenue performance this year. In 2021, profit dropped by 30% and SAP have not yet recovered from that. What could be read from this is increased costs at SAP are causing a lack of increased profits. It is possibly due to the investment in the RISE with SAP program and S/4HANA cloud. The margins on new programs and technology are often lower, so we may see growth in profits return next year as SAP become more established in these areas.

This of course leads onto the big announcement that SAP are reducing their employee count by 3,000, around 2.5% of their workforce. Given their revenue is up and their profit is not, it is not a wholly unsurprising announcement and is in line with what other major technology companies are doing at the moment too.

Interesting points of note:

- SAP have indicated that they intend to sell Qualtrics despite a strong financial performance.

- Litmos has been sold by SAP to Francisco Partners.

- Share prices drop.

What we can conclude from SAP’s 2022 financial results

On the surface SAP had a strong 2022 with major increases in key strategic areas. Reading between the lines, we wonder whether these increases in revenue are truly indicative of customers choosing RISE with SAP and S/4HANA Cloud or if they are actually showing a relatively static customer base who wish to remain on-premise. Expect SAP to retain their focus on driving cloud revenue when communicating with them this year.