Enterprise Software – From Tough Tactics to Escalated Control

Enterprise software vendors are shifting from audits to systemic lock-ins. Read more and discover how enterprises can adapt in the new escalation era.

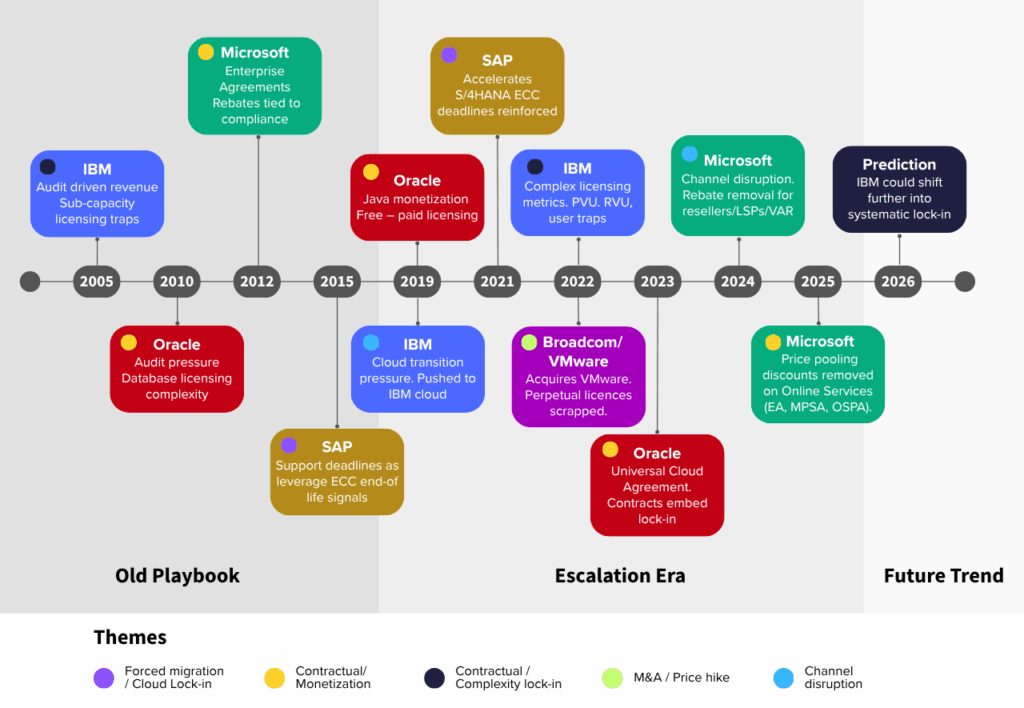

For decades, enterprise software vendors have not been customer-first. IBM, Oracle, Microsoft, SAP — and more recently Broadcom through VMware — have all relied on tough, revenue-protective tactics to control customers and protect growth.

What’s changed since 2019 is not the intent but the execution. The old playbook of audits, compliance checks, and support deadlines is giving way to something subtler and harder to fight: systemic, contract-embedded lock-ins that limit choice and raise costs. This marks a new era of risk for enterprise buyers.

ITAA has been reporting on and consulting around the impact of each of these catalyst events for some time. What’s striking now is how, taken together, they reveal an overarching shift in vendor tactics that is reshaping the entire enterprise software industry.

The Old Playbook: Pressure You Could See Coming (Pre-2019)

All the major vendors built their businesses on predictable but tough tactics:

- IBM – audit-driven revenue, sub-capacity licensing traps via ILMT.

- Oracle – database licensing complexity and relentless audit pressure.

- Microsoft – Enterprise Agreements with rebates tied to compliance.

- SAP – support deadlines leveraged to drive upgrades.

This was the baseline: challenging relationships, but at least customers could anticipate and prepare.

The Escalation Era: 2019–Present

Since 2019, vendors have shifted from visible enforcement to embedded controls that are more structural and less negotiable.

- Oracle – Monetised Java (2019), turning a free technology into a billable one. Later introduced the Universal Cloud Agreement (2023), embedding lock-in directly into contracts. Oracle has also perfected the “shelfware trap,” where customers continue paying support on unused licences — often at rising rates — even when they try to reduce spend.

- Why You Need a Java Strategy Before Oracle Reaches Out – ITAA

- Oracle Can Track Your Java Downloads – ITAA

- The Best Oracle Java Alternatives in 2025 – ITAA

- Oracle’s Strategy Shift: The Hidden Cost Curve – ITAA

- SAP – Accelerated the forced migration to S/4HANA (2021) by discontinuing ECC support. Customers must re-platform or lose cover.

- Broadcom/VMware – Post-acquisition (2022), scrapped perpetual licences, introduced subscription-only models, steep price hikes, and restrictive bundling.

- VMware Under Broadcom: Challenges and Choices – ITAA

- VMware Users Now Face 180-Day Mandatory Reporting – ITAA

- Microsoft – In 2024, Microsoft disrupted the channel by removing rebates for resellers, LSPs, and VARs. In November 2025, it will remove price pooling discounts for Online Services (including Microsoft 365, Dynamics, and other cloud subscriptions), a change expected to significantly increase costs under Enterprise Agreements (EAs), MPSAs, and OSPA (China). While Microsoft officially presents this as ‘alignment with Azure pricing’ and part of its wider AI and cloud growth narrative, most industry professionals see it as a money-driven move that reduces customer leverage and accelerates the shift away from the EA model towards the Microsoft Customer Agreement (MCA).

- Independent by Design: SAM Is Not Our New Direction – ITAA

- Microsoft to End Cloud Volume Discounts – ITAA

- IBM – Acquired Red Hat (2019) to reposition itself around hybrid cloud and open source, with OpenShift strengthening its role in containerization and flexibility. At the same time, IBM continued to push customers towards its own branded ‘cloud’ offerings (2019–22), though these were never on the same scale as the hyperscalers. By 2022, entrenched licensing complexity, from PVUs and RVUs to container metrics, remained a powerful lock-in lever and may yet evolve into systemic, contract-based restrictions.

- IBM Software Licensing Trends 2024 – ITAA

👉 The shift: from visible audits and fees → to contractual and product strategies where lock-in is unavoidable.

Why This Matters Now

- Less visible – customers can’t “prepare for an audit” anymore; the restrictions are built into the software and contracts.

- Fewer choices – consolidation has reduced alternatives.

- Higher stakes – the rapid adoption of vendor-native AI (e.g., Microsoft Copilot, SAP Joule, Oracle AI/OCI AI Services) and reliance on integrated cloud platforms make it harder than ever to move between providers.

- Deep dependency – vital platforms such as Microsoft Office, M365, and Windows underpin the daily operations of most organisations, making the idea of moving away feel almost impossible.

- Weak deterrence – public backlash and legal challenges have had little effect on vendor behaviour.

What Customers Must Do

To survive this escalation era, enterprises need to rethink how they engage:

- Treat every negotiation as part of a lifecycle strategy, not a one-off deal.

- Negotiate flexible termination clauses wherever possible to preserve choice.

- Diversify vendors to avoid single-source dependency.

- Use independent expertise to benchmark, model, and stress-test contract terms before signing.

- Know your numbers better than the vendor does. Vendors thrive on information gaps. Enterprises that track their own usage and entitlements, with the right expertise, enter negotiations from a position of strength.

Looking Ahead: Watch This Space

The “Old Playbook” of audits and compliance threats hasn’t disappeared, but it has been overshadowed by new systemic tactics. Vendors are now embedding control into the very contracts, products, and pricing models that enterprises rely on.

Prediction: IBM and others will follow Oracle and Microsoft’s lead in adopting even more structural, hard-to-escape approaches. Customers should expect this, not be surprised by it.

Closing Thoughts

The enterprise software industry hasn’t suddenly turned hostile, it always was. What’s changed is the level of sophistication and subtlety in how vendors extract value. For CIOs and procurement leaders, this is the new normal. Staying ahead means recognising the escalation and preparing accordingly.

📢 Follow ITAA to stay informed on the trends and tactics shaping enterprise software.

Tom Bracher, Commercial Director

Tom brings over 20 years of procurement experience across Finance, Automotive, Energy, Aerospace, and Retail. He leads ITAA’s Commercial Vertical in the UK, US, and Europe, specializing in transformation programs, complex contract negotiations, and supplier strategies to deliver optimal spend and value outcomes for clients.

Need Clarity or Guidance?

Contact us to understand how these changes can affect your organization – and how to turn them into an advantage.